Why You Ought to Think often About Solace Frameworks USA’s Areas of strength for nyse:fix On Capital

To find a stock that could duplicate over the long haul, what are the basic patterns we ought to search for? In addition to other things, we’ll need to see two things; right off the bat, a developing profit from capital utilized (ROCE) and furthermore, an extension in the organization’s measure of capital utilized. In the event that you see this, it normally implies it’s an organization with an extraordinary plan of action and a lot of beneficial reinvestment valuable open doors. Along these lines, when we ran our eye over Solace Frameworks USA’s (NYSE:FIX) pattern of ROCE, we truly preferred what we saw.

For the people who don’t have the foggiest idea, ROCE is a proportion of an organization’s yearly pre-charge benefit (its return), comparative with the capital utilized in the business. To work out this measurement for Solace Frameworks USA, this is the equation:

Return on Capital Utilized = Profit Before Interest and Duty (EBIT) ÷ (Complete Resources – Current Liabilities)

0.24 = US$369m ÷ (US$3.1b – US$1.6b) (In light of the following a year to September 2023).

Accordingly, Solace Frameworks USA has a ROCE of 24%. That is a fabulous return and not just that, it dominates the normal of 9.8% procured by organizations in a comparable industry.

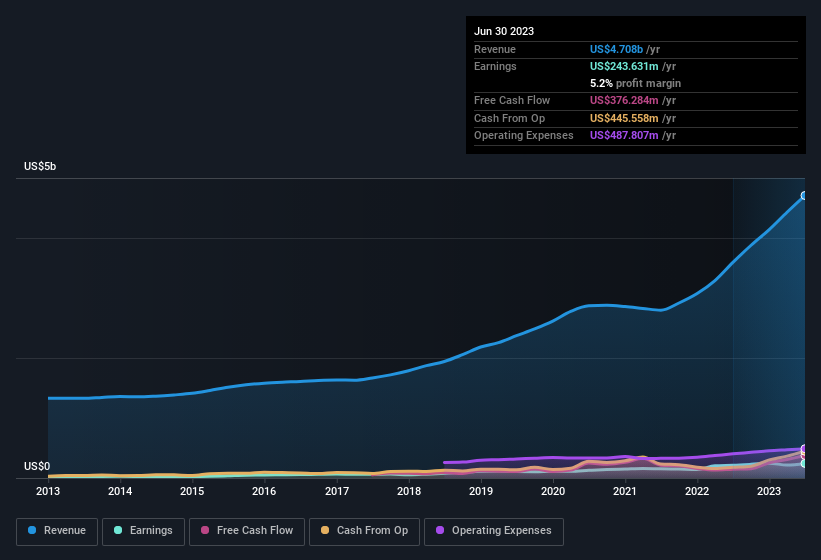

Above you can perceive how the ongoing ROCE for Solace Frameworks USA analyzes to its earlier profits from capital, yet there’s just such a lot of you can tell from an earlier time. Assuming you might want to see what examiners are determining proceeding, you ought to look at our free report for Solace Frameworks USA.

It’s hard not to be dazzled by Solace Frameworks USA’s profits on capital. Throughout the course of recent years, ROCE has remained generally level at around 24% and the business has sent 146% more capital into its activities. Presently taking into account ROCE is an alluring 24%, this mix is really engaging on the grounds that it implies the business can reliably give cash something to do and create these significant yields. In the event that these patterns can proceed, it would make perfect sense if the organization turned into a multi-bagger.

On a side note, Solace Frameworks USA’s ongoing liabilities are still fairly high at 52% of all out resources. This can achieve a few dangers on the grounds that the organization is essentially working with a somewhat enormous dependence on its providers or different kinds of momentary lenders. In a perfect world we might want to see this lessen as that would mean less commitments bearing dangers.

To put it plainly, we’d contend Solace Frameworks USA has the makings of a multi-bagger since its had the option to intensify its capital at truly productive paces of return. What’s more, the stock has compensated investors with a noteworthy 393% re-visitation of those who’ve held throughout recent years. So while the positive basic patterns might be represented by financial backers, we actually think this stock merits investigating further.

Another thing to note, we’ve recognized 1 admonition sign with Solace Frameworks USA and understanding this ought to be essential for your speculation interaction.

If you have any desire to look for additional stocks that have been acquiring exceptional yields, look at this free rundown of stocks with strong monetary records that are likewise procuring exceptional yields on value.

Have input on this article? Worried about the substance? Reach out to us straightforwardly. Then again, email article group (at) simplywallst.com.

This article by Just Money St is general in nature. We give critique in light of authentic information and examiner gauges just utilizing a fair-minded philosophy and our articles are not planned to be monetary counsel. It doesn’t comprise a proposal to trade any stock, and doesn’t assess your goals, or your monetary circumstance. We mean to bring you long haul centered investigation driven by central information. Note that our examination may not consider the most recent cost delicate organization declarations or subjective material. Basically Money St has no situation in any stocks referenced.